I always believed I had the means to create the wealth I desired and if not, I’d find a way to obtain it. Not in a way of greed but access. Its been almost 5 years since graduating from grad school & between undergraduate days & embarking on a new career journey in corporate america, I’ve had time to fine tune a few personal finance principles that have kept me financially solvent.

I’ve been structured & therefore conscious with my approach to personal finances & because of this, I’ve been able to make certain preferred decisions and inch closer to the version of financial success & freedom I’ve envisioned. By incorporating practical, balanced principles that are a reflection of my personal values & goals, as well as focusing on the things in my direct control, have ultimately provided the best results.

Pants: PrettyLittleThing Bodysuit: Leith Heels: Vince Camuto – DSW

So many misconceptions surround the perspective of “Financial freedom”. Living a life free of financial obligations does not necessarily mean having millions in the bank or expensive possessions. Financial freedom can actually have many definitions & look different to different people. This could mean having a combination of paying off credit card & mortgage debt down to a balance of zero, living comfortably on a fixed income funded by small personal investments or simply not being stressed about having the money available to cover basic essential bills. Therefore, understanding this can help you make the conscious efforts necessary to improve your financial habits and incorporate the principles to achieve your ideal financial success.

Budget

When done correctly & when the parameters are maintained, a budget can be your most valuable life tool as it relates to personal financial goals. Budgeting requires being conscious of the types & amounts of expenses accumulated & is the foundation when planning for the unexpected, reaching saving goals and making business investment plans. Budgets should be revisited on a yearly basis with the exception of significant unanticipated events.

Document the following through Spreadsheet, Sticky Notes or using the Mint Budget App:

- Identify Earnings and Take Home Pay

- Review Bank Statements (Accounts & Credit Cards)

- Compare Incoming and Outgoing Amounts

- Categorize Spending Trends

Manage

Set realistic goals based on the above accumulated information.

- Monitor credit card purchases. Keep the balance to a minimum and meet the monthly payoff schedule this way you are not subject to unruly amounts of interest.

- Prioritize needs over wants & remain committed

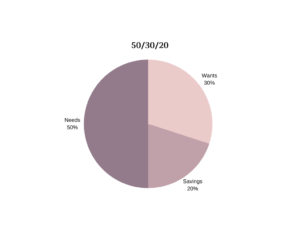

- Use the 50/30/20 Rule (see below)

Track

Get visual, put things into perspective. Use resources like the Mint Budget App or an old fashioned spreadsheet to help keep up with how well your set budget is working. I like to check in weekly on my spending, this way if I need to adjust to make it through the end of the month on budget I can do so accordingly.

Restrain

Unfortunately, we’ll always be pressured by the constant external temptations and enticements we’re faced with on a daily basis with social media not being much of any help. However, controlling urges to make purchases outside of the financial parameters you set will be more satisfying and gratifying in the long run.

Spend according to budget and don’t spend before the money appears in your account.

Review

Revisiting your budget regularly is necessary for determining whats working, what isn’t, what needs more attention, where you may be able to save more or extra money you can dedicate to your proportioned “wants”. Do this on a regularly basis. As often as monthly and most certainly on a yearly basis. Always plan and always review.